Germany, renowned for its precision engineering and rich cultural tapestry, is also becoming a hotspot for the global freelance movement. As the dynamics of traditional employment change, more individuals are exploring the path of self-employment right in the heart of Europe. But before you set out on this journey, it is necessary to understand what freelancing in Germany means, particularly, navigating the intricacies of their bureaucracy.

This guide is designed to provide an insightful overview of what it means to freelance in Germany. Whether you’re pondering the shift from a full-time role or are a seasoned freelancer aiming to explore the German market, let’s embark on this enlightening journey together.

Understanding the German Freelance Landscape

In Germany, a freelancer is termed a Freiberufler. This title isn’t just a linguistic difference; it carries legal and tax-related distinctions. Unlike many other countries where ‘freelancer’ is a casual term, in Germany, the label comes with official recognition and specific responsibilities. In fact, freelancing in Germany is one of the many ways in which the youth and the public thrive in the country.

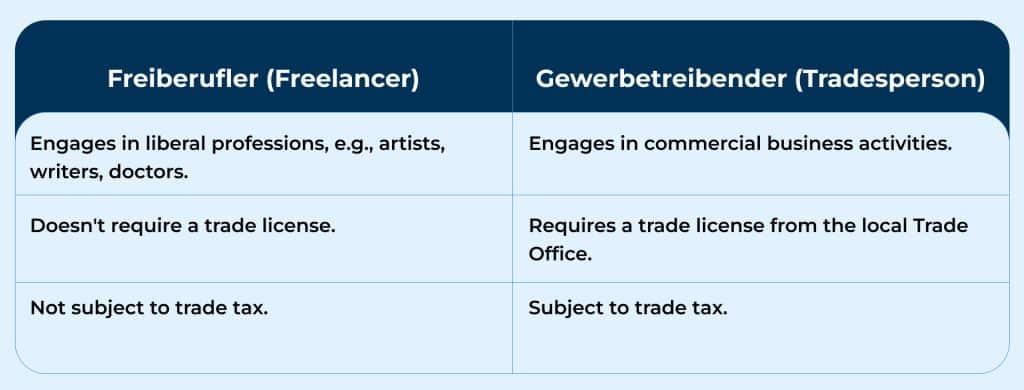

One primary distinction lies between a Freiberufler and a Gewerbetreibender (tradesperson). Let’s break it down:

So, what kind of professional spaces are hiring freelancers in Germany?

Well, that’s a loaded question. Freelancing in Germany thrives across various sectors. Notably, these professions are especially receptive to freelancers:

- IT and Software Development: High demand for developers, data analysts, and IT consultants.

- Design and Media: Graphic designers, illustrators, videographers, and journalists.

- Consulting: Business, management, and strategic consultants.

- Teaching and Training: Language instructors, corporate trainers.

- Healthcare: Physiotherapists, nutrition consultants.

Registration Formalities For Freelancing in Germany

Before you start freelancing in Germany, you need to navigate through some administrative steps. Here’s a concise roadmap to kickstart your self-employment:

- Visit the Local Tax Office (Finanzamt): Declare your freelance activities here to get started.

- Complete the Questionnaire for Tax Collection (Fragebogen zur steuerlichen Erfassung): This document captures the specifics of your freelance work.

- Await the Tax Number (Steuernummer): Once registered, the tax office will provide you with this essential number.

The Steuernummer isn’t just another bureaucratic term; it’s pivotal for invoicing clients and declaring taxes. Moreover, depending on your annual revenue, you may also be liable for VAT (Umsatzsteuer). Keep an eye on the thresholds, as surpassing them requires you to charge VAT on your services.

Lastly, some professions may require you to join a professional chamber or association. For instance, doctors must register with their state’s Medical Association (Ärztekammer), while architects enlist with their respective Chamber of Architects (Architektenkammer). This not only offers professional recognition but also provides resources and networks that can be invaluable in your freelance journey.

Keep Your Eyes Out: Studio Apartments For Rent in Berlin

Taxes and Social Security Contributions for Freelancers

Germany, with its robust economy, offers freelancers myriad opportunities. However, this comes hand-in-hand with a structured tax and social security system that every freelancer should understand.

The German tax system for freelancers operates primarily on an income-based approach. Freelancers declare their earnings through an annual tax return, calculating their taxable income after accounting for business-related expenses. The progressive tax rate then determines the actual tax payable, which can range from 0% for minimal incomes to approximately 45% for higher incomes.

VAT (Umsatzsteuer) represents a significant aspect of the tax landscape. As a freelancer, if your earnings exceed €22,000 in the first year of business, you’re obligated to charge VAT on your services. In subsequent years, this threshold increases to €50,000. There are some exceptions, notably for journalists, writers, and artists. Furthermore, while the standard VAT rate is 19%, a reduced rate of 7% applies to specific services, like books or certain cultural activities.

Social security is quite comprehensive. Employees freelancing in Germany must address:

- Health Insurance (Krankenversicherung): Mandatory for everyone. Freelancers choose between statutory public health insurance or private options.

- Pension (Rentenversicherung): Voluntary for most freelancers, but some professions like teachers or healthcare workers might have mandatory contributions.

- Long-term Care and Unemployment Insurance: Generally optional for freelancers.

Lastly, the German tax system offers a plethora of deductions. Regular expenses related to freelancing in Germany, such as office rent, equipment, travel for work, or further education, can be deducted. It’s also wise to keep an eye out for special allowances, like the Arbeitszimmer deduction for home offices.

Navigating taxes and contributions can seem daunting, but with thorough understanding and planning, you can make the most out of your freelancing earnings in Germany.

What Insurance Do You Need to Freelance in Germany?

In Germany, the safety net of insurance doesn’t just benefit salaried employees; it’s equally relevant for freelancers. With the autonomy of self-employment comes the responsibility of ensuring you’re covered against unforeseen risks.

The cornerstone of insurance for any resident in Germany, including freelancers freelancing in Germany, is health insurance (Gesetzliche Krankenversicherung for public and Private Krankenversicherung for private). It’s mandatory. Public health insurance is state-regulated, with premiums based on income, offering a comprehensive cover. Private insurance, on the other hand, is based on individual risk factors and often provides faster access to specialists or premium services, though it might be pricier.

A crucial insurance that freelancers often overlook is professional liability insurance (Berufshaftpflichtversicherung). Especially for consultants, IT professionals, or any service provider, it safeguards against claims for damages by clients due to alleged or actual negligence. In many professions, having this insurance not only offers peace of mind but also enhances your professional standing.

Beyond these, there are other insurances that freelancers should consider:

- Accident Insurance (Unfallversicherung): Compensates for accidents during work or personal time, providing financial support during recovery or in the case of permanent disability.

- Disability Insurance (Berufsunfähigkeitsversicherung): Provides a monthly payout if you become unable to work in your profession due to prolonged illness or disability.

While freelancing in Germany, the regular corporate safety nets might be absent. Evaluating your risks and investing in appropriate insurance policies ensures that unexpected events don’t derail your professional journey.

Finding Work and Networking While Freelancing

In Germany’s dynamic freelance landscape, securing work and forging connections isn’t merely about having a top-notch skill set; it’s also about knowing where to look and how to interact.

- The digital age has ushered in numerous online platforms dedicated to freelancers. Websites like Freelancer.de and Twago and global platforms like Upwork and Fiverr are teeming with opportunities tailored for diverse professions. Additionally, local job boards, both online and in community spaces, can be goldmines for projects that cater specifically to the German market.

- German networking events, such as Stammtisch (informal regular meet-ups) or organized events by associations like VGSD (Association of Freelancers and Self-Employed in Germany), provide excellent platforms to meet peers, potential clients, and industry stalwarts.

- Building a professional reputation here isn’t just about the quality of work but also punctuality, reliability, and adherence to commitments. Germans value punctuality and directness, so ensure you honor timelines and communicate clearly.

- Lastly, be aware of cultural nuances. In professional settings, Germans often prefer formal titles until explicitly invited to use first names. Active listening, respect for hierarchy, and ensuring that communication is precise and clear can go a long way in establishing fruitful professional relationships.

In essence, thriving while freelancing in Germany requires blending the power of online platforms with traditional networking and respecting cultural norms.

Challenges and Tips for Success While Freelancing in Germany

Freelancing in Germany, while promising, does present its share of challenges. Some common hurdles include:

- Navigating Bureaucracy: The German administrative system can be complex, especially around tax and legal formalities.

- Language Barrier: Not all clients or agencies operate in English; proficiency in German can be a game-changer.

- Competition: The freelance market, especially in cities like Berlin or Munich, is competitive. Standing out requires consistent quality and specialization.

- Payment Delays: While German professionalism is commendable, payment delays can occasionally crop up, affecting cash flow.

To ensure success amidst these challenges:

- Set Clear Boundaries: Dedicate specific hours for work and leisure to maintain a work-life balance.

- Diversify Client Base: Don’t rely heavily on one or two clients. A diverse portfolio reduces income unpredictability.

- Network Actively: Regularly attend events and join freelancer associations to stay updated and build contacts.

- Financial Planning: Anticipate the ebb and flow of freelance income. Save during good times to sail smoothly during lean periods.

Start Your German Freelancing Journey Today…

Freelancing in Germany offers a fusion of tradition and modernity, structure and freedom. As the heart of Europe pulses with opportunities for self-employed professionals, it’s paramount to understand the intricacies of this thriving ecosystem.

From mastering the art of networking in a culture that values precision, to navigating the winding roads of German bureaucracy, the journey is both challenging and rewarding.

With the right mix of preparation, cultural understanding, and continuous learning, the promise of freelancing in Germany awaits.