Have you ever wondered how much of your hard-earned money goes towards taxes in Germany? Well, let’s dive into the world of taxes and explore the income tax rates, value-added tax, and other taxes and fees that individuals and businesses may be subject to. From the progressive income tax system to the solidarity surcharge, we’ll uncover how the tax rate in Germany is calculated and what it means for your wallet. So buckle up, grab your calculator, and let’s dive into the world of tax rates in Germany!

The German Tax System

Germany has a progressive income tax system, which means that the more you earn, the higher your tax rate will be. There are also various other taxes and fees that individuals and businesses may be subject to. This includes sales tax and social security contributions.

- The basic tax-free allowance has been increased to €10,908, and the tax brackets have been shifted to the right. This means that individuals will pay a lower tax percentage on their first €10,908 of income and a higher percentage on income above that amount. The solidarity surcharge is still set at 5.5% of income tax, but there is a minimum tax exemption of €10,000 for single taxpayers and €20,000 for married couples filing a joint tax return. This means that individuals with incomes below these amounts will not be required to pay the solidarity surcharge. Social security contributions are calculated as a percentage of gross income, up to a certain threshold. The contribution rates for employees and employers vary depending on the type of social security coverage.

- The basic tax-free allowance has been increased to €10,908, and the tax brackets have been shifted to the right. This means that individuals will pay a lower tax percentage on their first €10,908 of income and a higher percentage on income above that amount.

- The solidarity surcharge is set at 5.5% of income tax, but there is a minimum tax exemption of €10,000 for single taxpayers and €20,000 for married couples filing a joint tax return. This means that individuals with incomes below these amounts will not be required to pay the solidarity surcharge.

- Social security contributions are calculated as a percentage of gross income, up to a certain threshold. The contribution rates for employees and employers vary depending on the type of social security coverage.

How Does the Tax System in Germany Work?

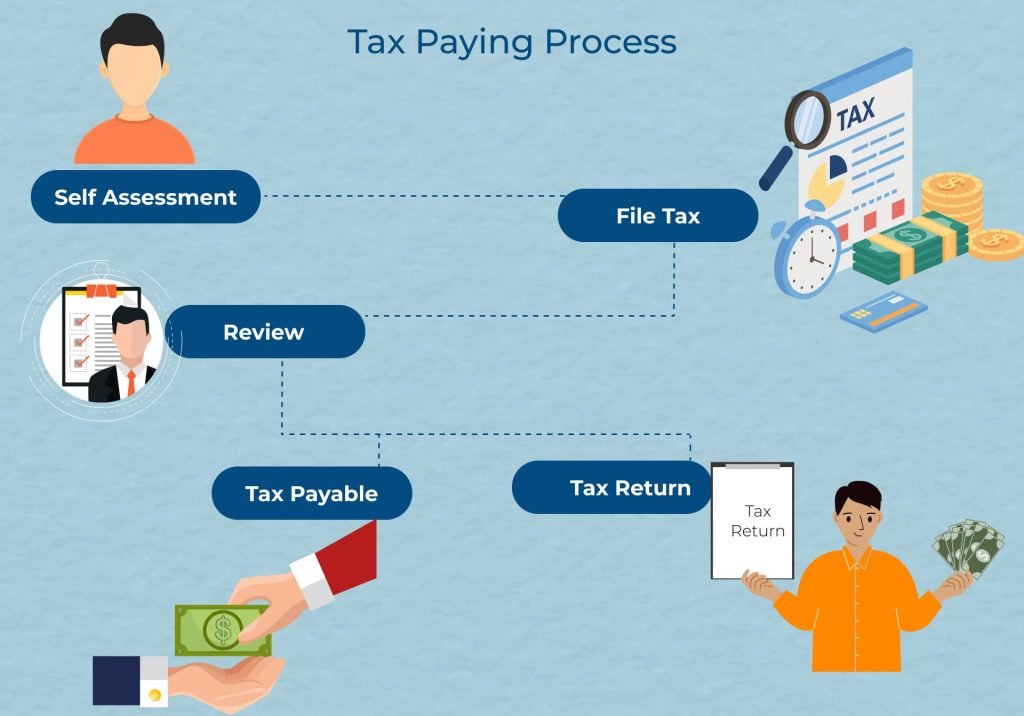

The German taxation system is based on a self-assessment principle, meaning taxpayers are responsible for calculating and reporting their own income and paying taxes accordingly. Here are the key steps in the taxation process in Germany:

Determine your taxable income

To determine your taxable income, you need to add up all your income from various sources, including employment income, self-employment income, rental income, and investment income. You can deduct certain expenses from your taxable income, such as business expenses, donations, and certain insurance payments.

File your tax return

Once you have determined your taxable income, you need to file a tax return with the tax authorities. In Germany, the tax year is the same as the calendar year, and the deadline for filing a tax return is usually May 31 of the following year. You can file your tax return online or by mail.

Receive your tax assessment

After filing your tax return, the tax authorities will review your return and issue a tax assessment. This assessment shows the tax amount you owe or the refund you are entitled to.

Pay your taxes or receive your refund

If you owe taxes, you need to pay them by the deadline specified in the tax assessment. If entitled to a refund, the tax authorities will transfer the refund to your bank account.

Appeal or file a tax objection

If you disagree with the tax assessment, you have the right to appeal or file a tax objection within one month of receiving the tax assessment.

What are Taxes used for in Germany?

German taxes fund various government programs and services, including but not limited to:

- Social Security: Taxes fund Germany’s social security system, which provides retirement, disability, and healthcare benefits to German citizens and residents.

- Education: To fund Germany’s education system, which includes public schools and universities.

- Infrastructure: To build and maintain Germany’s infrastructure, including roads, bridges, public transportation, and utilities.

- Defence: Taxes also support Germany’s military and defence programs.

- Healthcare: To fund Germany’s healthcare system, which provides medical care and treatment to German citizens and residents.

- Public Safety: Taxes also fund Germany’s police and emergency services, which help ensure public safety and respond to emergencies.

- Environmental Protection: To fund environmental protection programs and initiatives to reduce pollution, protect natural resources, and mitigate climate change’s effects.

German taxes fund a wide range of programs and services essential to the well-being of all those residing in Germany.

Tax Rate for Expats in Germany

Expats living and working in Germany are subject to the same tax laws as German citizens. This means that if you are an expat living in Germany, you may have to pay income tax on your earnings, and you may also be subject to other taxes and fees, such as social security contributions and value-added tax (VAT).

The tax rates for expats in Germany are the same as those for German citizens, with a progressive income tax system that ranges from 14% to 45%. The exact amount of tax that you will pay will depend on your income level, deductions, and exemptions.

Depending on their circumstances, immigrants living in Germany may also be eligible for certain tax breaks and exemptions. For example, suppose you are an expat who has moved to Germany for work. In that case, you can claim a tax deduction for certain relocation expenses, such as the cost of moving your household goods or temporary lodging.

In addition to income tax, expats living in Germany may also be subject to social security contributions designed to fund the country’s social welfare system. These contributions are typically split between the employee and the employer and are calculated based on a percentage of the employee’s income.

Overall, expats living and working in Germany are subject to the same tax laws and rates as German citizens, but certain tax breaks and exemptions may be available to help reduce their tax burden. Expats need to understand their tax obligations and seek professional advice if necessary to comply with all relevant tax laws.

Tax Rate for Rental Properties in Germany

Renting in Germany is a popular option for many individuals and families, and it’s essential to understand the tax implications of renting a property in the country.

In Germany, temporary tenants (under 6 months) must pay a monthly rental fee, typically subject to a value-added tax (VAT) rate of 7%. Landlords are responsible for paying this VAT amount to the government, but they can also pass on the cost to tenants by including it in their monthly rent. For leases beyond 6 months, there is no VAT in Germany!

In addition to rental fees, tenants in Germany may also be subject to a security deposit, which is usually equal to three months’ cold rent. The security deposit intends to cover any damages to the property during the tenancy, and it is refundable at the end of the lease term, provided that the property is in good condition. Also, remember that the security deposit amount cannot be adjusted for the monthly rent!

From a tax perspective, landlords in Germany must pay income tax on the rental income they receive from tenants. This income is subject to the same progressive income tax rates as other forms of income, and landlords can also deduct certain expenses, such as maintenance and repair costs, from their taxable rental income.

For tenants, the cost of renting a property is not tax-deductible. This means they cannot claim a deduction for their rental payments on their income tax return. However, some individuals may be eligible for housing benefits or rental assistance from the government if they meet certain income and residency requirements.

Renting in Germany is convenient and affordable for individuals and families. But, it’s essential to understand the tax implications and obligations for tenants and landlords.

How to Reduce Your Tax Rate in Germany?

There are several ways that individuals in Germany can reduce their tax burden and pay less in taxes. Here are some strategies that may be helpful:

Take advantage of tax deductions

There are various tax deductions available in Germany, including deductions for work-related expenses, childcare expenses, and certain medical expenses. By keeping track of your expenses and claiming these deductions, you can reduce your taxable income and lower your tax bill.

Contribute to retirement savings

Contributions to a pension plan or other retirement savings account may be tax-deductible in Germany. This can help lower your taxable income and reduce your tax bill.

Invest in tax-advantaged accounts

Certain investment accounts, such as a Riester pension, can offer tax benefits in Germany. Investing in these accounts can reduce your taxable income and pay less in taxes.

Donate to charity

Charitable donations in Germany may be tax-deductible. This means that you can reduce your taxable income and lower your tax bill by donating to eligible charities.

Consider income splitting

If you are married or in a civil partnership, you may split your income with your spouse to reduce the overall tax burden. This can be particularly beneficial if one partner earns significantly less than the other.

It’s important to note that these strategies may not be suitable for everyone. And it’s always a good idea to seek professional advice before making any major financial decisions. Additionally, it’s crucial to ensure that you comply with all relevant tax laws and regulations to avoid any potential penalties or fines.

How to Get Tax Returns in Germany?

If you have paid more in taxes in Germany than you owe, you may be eligible for a tax refund. Here are the steps to follow to get a tax refund in Germany:

- Collect your tax documents: You must gather all your tax documents, including income statements, tax deductions, and other relevant paperwork.

- Prepare and submit your tax return. You can prepare and submit your tax return either by yourself or with the help of a tax professional. You must complete a tax return form and provide all the required information.

- Wait for the tax assessment. Once you have submitted your tax return, the tax authorities in Germany will review your return and calculate your tax liability or refund.

- Receive your tax assessment. You will receive a tax assessment from the German tax authorities, indicating whether you owe additional taxes or are eligible for a refund.

- Request a tax refund. If you are eligible for a tax refund, you must submit a request to the tax authorities. You can do this either online or by mail.

- Receive your tax refund. Once your request has been approved, you will receive your tax refund, either by direct deposit or by mail.

It’s important to note that getting a tax refund in Germany can be complex, particularly if you need to become more familiar with the tax system or the language. Suppose you need help with how to proceed. In that case, it’s a good idea to seek professional advice from a tax professional or accountant. This helps comply with all relevant tax laws and regulations.

Conclusion

In conclusion, the German taxation system is a key component of the country’s social and economic infrastructure. It funds essential government programs and services that support the well-being of German citizens and residents. This includes healthcare, education, infrastructure, social security, and public safety. While navigating the taxation process in Germany can be complex, it ultimately serves a vital purpose. This includes ensuring the country’s public resources are fairly distributed and effectively managed. By contributing to the taxation system, individuals and businesses play a crucial role in supporting the common good and helping to build a strong, prosperous, and equitable society for all.

The tax system in Germany can be complex and challenging to navigate. However, it is designed to ensure that individuals and businesses pay their fair share of taxes and contribute to the country’s social welfare programs.

Disclaimer: Financial decisions should be made based on careful consideration of your individual circumstances and goals. It is always recommended to consult with a qualified financial advisor, accountant, or other professional before making any financial decisions or investments.

It’s essential to conduct your own research and seek personalised advice from professionals to make informed financial choices. We are only here to inform you about the process!