Have you ever wondered how banks, landlords, and other businesses in Germany decide whether or not to lend you money or rent an apartment? Well, it turns out a secret agent is working behind the scenes to help them make that decision. And its name is Schufa!

Schufa is like your personal financial James Bond, collecting information about your creditworthiness and generating a secret credit score that helps financial institutions evaluate the risk of lending to you. It’s kind of like a secret agent that only banks and other authorised parties have access to, and it helps them make informed decisions about whether or not to trust you with their money or property.

But don’t worry, Schufa isn’t spying on you like a secret agent. It’s just collecting information about your payment history, outstanding debts, and any defaults or bankruptcies you may have had.

Let us take a detailed look into what Schufa is and why and how it plays a major role in life in Germany.

What is a Schufa?

SCHUFA is an acronym for Schutzgemeinschaft für allgemeine Kreditsicherung, meaning General Credit Protection Agency. This agency tracks and rates your payment history and generates the report on behalf of SCHUFA Holding AG, Germany’s largest private credit tracking agency.

This organisation tracks all of your payments, keeps an eye on your financial behaviour, and verifies your reliability through your payment history.

A good Schufa score makes it simpler to apply for a loan or locate housing. Some banks will only allow you to open a bank account if you have a good Schufa.

How Does It Work?

Basically, when a third party, such as a bank or your landlord, requests a copy of your SCHUFA record, they are evaluating your ability to make timely bill payments. This report lists all businesses you’ve bought from and previously contacted the SCHUFA to inquire about your solvency.

When you register your address, establish a bank account, receive internet for your apartment, or sign up for a cell phone contract, your SCHUFA record is automatically created. Each time companies accept you as a customer, the providers check with the SCHUFA and so leave a record.

Your employment position or income does not impact your credit score; only your reliability regarding obligations such as debts, loans, and other responsibilities.

With a low SCHUFA score, the richest person in the world, for instance, could not open a bank account or obtain a credit card in Germany (Interesting, huh?!).

How to get your Report?

A Schufa report can be obtained in many ways. But how you obtain your report is very important, mostly because everyone accepts the report obtained in a different manner. For e.g., landlords and banks may accept the same report but only when it is obtained as per their requirement. Therefore, be sure to get your report bearing in mind the purpose of its need.

SCHUFA Holding AG gathers your financial information from a variety of sources, including mobile phone providers, banks, credit card issuers, internet service providers, etc. The organisation will then create a financial report to describe your credibility and dependability.

Your credibility is reflected in your SCHUFA score. So, be careful to maintain a high level. You will see a decline in your score if you delay paying bills or miss payments. You put your credit at risk if your SCHUFA score drops.

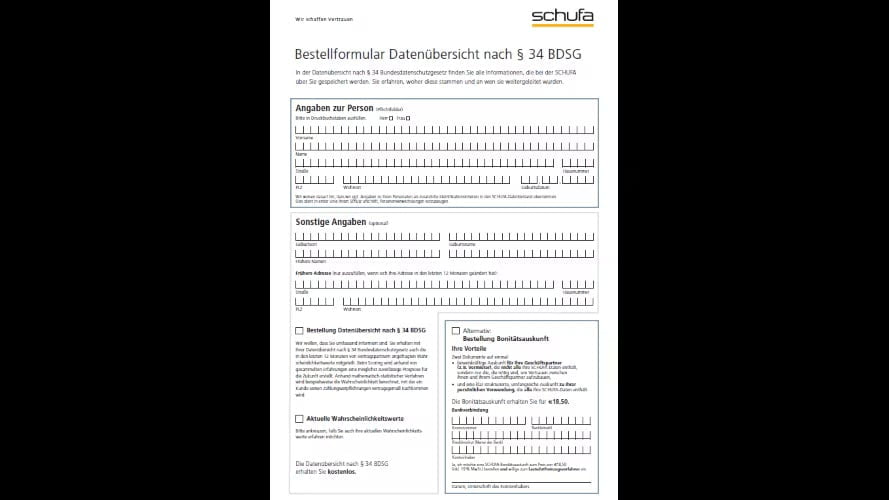

Are Schufa Reports Free?

Every resident of Germany is entitled by law to a free SCHUFA report each year. This is because the country believes every resident should have an equal opportunity to view their financial records.

To sign up for your free report, submit your request to the SCHUFA website. Enter the report’s name, Datenkopie (German for “data copy”). You will find the option Jetzt beantragen (which means ‘Apply Now’) in the right column. Enter all of your information on the screen that displays after selecting this option.

But you may only use this report for personal purposes. It cannot be transferred to a third party. For instance, you cannot provide your landlord with this free SCHUFA report if you wish to rent an apartment. This report is specifically for your use. It entitles you to a yearly review of your financial history.

You must apply for the paid report in order to share your SCHUFA record with a third party.

Can I get a Schufa Report Online?

If you need a SCHUFA report immediately and can’t wait for the free report to arrive in the mail after a few days, you can order one online. After entering all your details, you just have to pay 29,95 euros on the official website, and you can get the online report immediately.

All of the landlords acknowledge this report. In order to demonstrate your financial reliability to your landlord, you can give them a printed copy of this online report. You can even mail your landlord a soft copy of this report.

Schufa Report from the Bank

You can also get your Schufa report from your nearby bank. Go to your neighbourhood bank during business hours. Remember to take your passport and Meldebescheinigung (registration certificate) with you. The bank will charge you 29.95 euros for the report, regardless of whether you have an account there or not.

Any local bank has the right to issue you a Schufa report. But make sure you have a German bank account to withdraw the fee from your account.

Why is a Good Score so Important?

Making any financial contract in Germany requires a strong SCHUFA score.

Your SCHUFA report is mandatory for all financial transactions, including applying for a loan, renting an apartment, purchasing a cell phone, and buying an apartment. If your score is high, dealing with your financial concerns won’t be a problem. However, you will only be regarded as trustworthy in Germany with a high SCHUFA score.

Every time you try to open a bank account or apply for a credit card with a low SCHUFA score, your reliability will be questioned.

A high SCHUFA score is a surefire guarantee that you’ll pay your bills on time.

What is a Good Score?

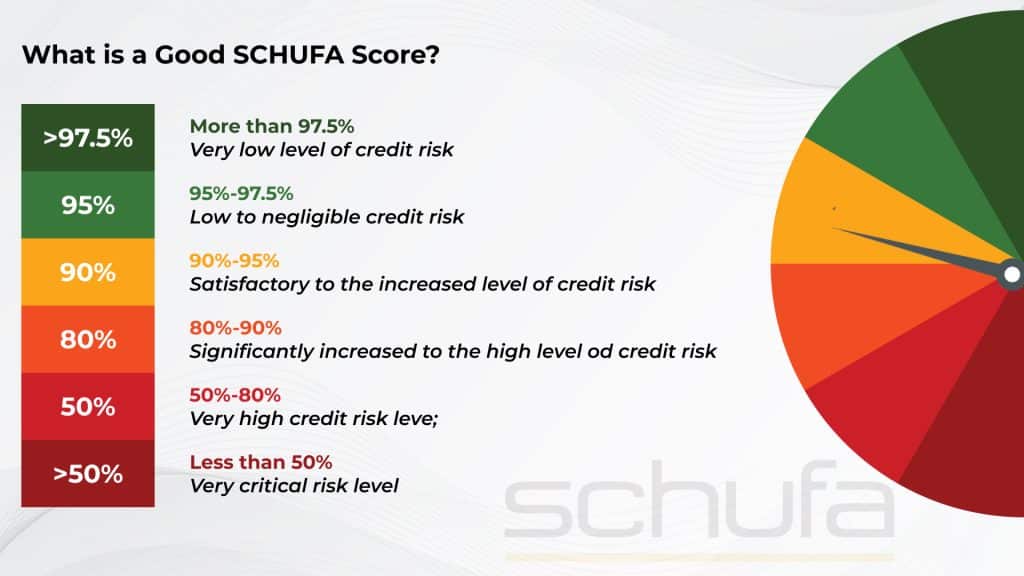

The SCHUFA score is sometimes also referred to as the Basis score, but they cannot be interchangeably used. The Basis score is a specific type of SCHUFA score that is calculated using a different formula than the standard SCHUFA score. The Basis score is typically used by banks and other financial institutions to assess creditworthiness.

There is a common misconception that you start with a score of 100 for your financial history right from your first transaction and that if you make on-time bill payments, it will stay at 100. You do not start with a score of 100 for your financial history right from your first transaction. Your SCHUFA score is calculated based on the information that Schufa has collected about your financial history. This information may include things like your credit history, payment history, and outstanding debts. If you do not have any credit history, your SCHUFA score will be 0.

Your SCHUFA score can increase over time, even if you have a few late payments. The most important factor in determining your SCHUFA score is your overall payment history. If you make most of your payments on time, your SCHUFA score will gradually increase over time.

A SCHUFA score of 97% or higher is considered very good. A 95% score is also commendable. However, you do not need to maintain a SCHUFA score of at least 95% to be considered creditworthy. Most banks and other financial institutions will consider a SCHUFA score of 90% or higher to be acceptable.

How to Maintain a Good Score?

Maintaining a good SCHUFA score is critical for your life in Germany. If you’re looking for tips to keep your score high, here are some suggestions :

- Make sure to pay all of your bills on time. Your score will be affected if you make late payments on your bills.

- Deactivate some of your credit cards if you have too many. Keep only those that are extremely necessary. Only keep credit cards that are used. Inactive credit cards should be cancelled.

- Keep your bank account from being empty. Keep it healthy instead to maintain a good score.

- Limit the number of bank accounts you open. Keep inactive bank accounts to a minimum if you desire a good score.

- Avoid switching your bank accounts often. If you switch frequently, you’ll be prompted to make mistakes with your accounts. As a result, your financial history will demonstrate your careless behaviour.

- Use the free report each year to examine your history. Verify that it is error-free. If you find any errors in your record, file an objection immediately to correct them.

- Your score may suffer if you move around a lot. Try to avoid that.

- Instead of occasionally taking small loans, take a larger loan. Unlike multiple smaller loans, one larger loan will have a less detrimental effect on your SCHUFA score.

Is It Possible to Rent an Apartment without Schufa?

Expats frequently encounter the classic chicken-and-egg problem of wanting a SCHUFA to show their prospective landlord but lacking one since they have yet to register with an address as they have yet to get a place. Still, you need the Schufa to get a place, and so on (You get the Chicken and Egg analogy now, don’t you?)

Now, the easy and almost only way to rent an apartment if you don’t have your SCHUFA yet is to rent from landlords who don’t ask for one! Simple right?!

But not quite!

Almost no landlords in Germany will rent you their property without a SCHUFA!

Here’s where Landlords like Urban Ground can help you.

If you have just landed in Germany and you don’t have your it yet, you can still rent an apartment from Urban Ground, with the credit score from the country you are moving in from or your bank statement for the last 3 months, as a replacement doc to SCHUFA. This is something that only Urban Ground does in Germany in order to make moving to the country easier for people. Almost no other landlords provide this flexibility. Usually, no SCHUFA means no rental contract!

Now, there’s also something very important that you need to keep in mind. If you miss out on paying your bills like rent and the case gets transferred to a debt collection agency or ends up in court, it will affect your credit worthiness and in turn your SCHUFA. So make absolute certain that you pay your rent (and other bills too of course) on time so it doesn’t mess up your SCHUFA!

Conclusion

Whether you like it or not, the SCHUFA must be your friend. Your ability to obtain a loan, a cell phone contract, or that new TV you wish to pay in instalments depends on the report’s tracking and rating of your payment behaviour.

So the next time you’re applying for a loan or trying to rent an apartment in Germany, just remember that Schufa is there to help you and the businesses you’re working with make informed decisions. And who knows, you’ll get your secret agent credit score one day!

Hence, always try to maintain your Schufa at a cent!!